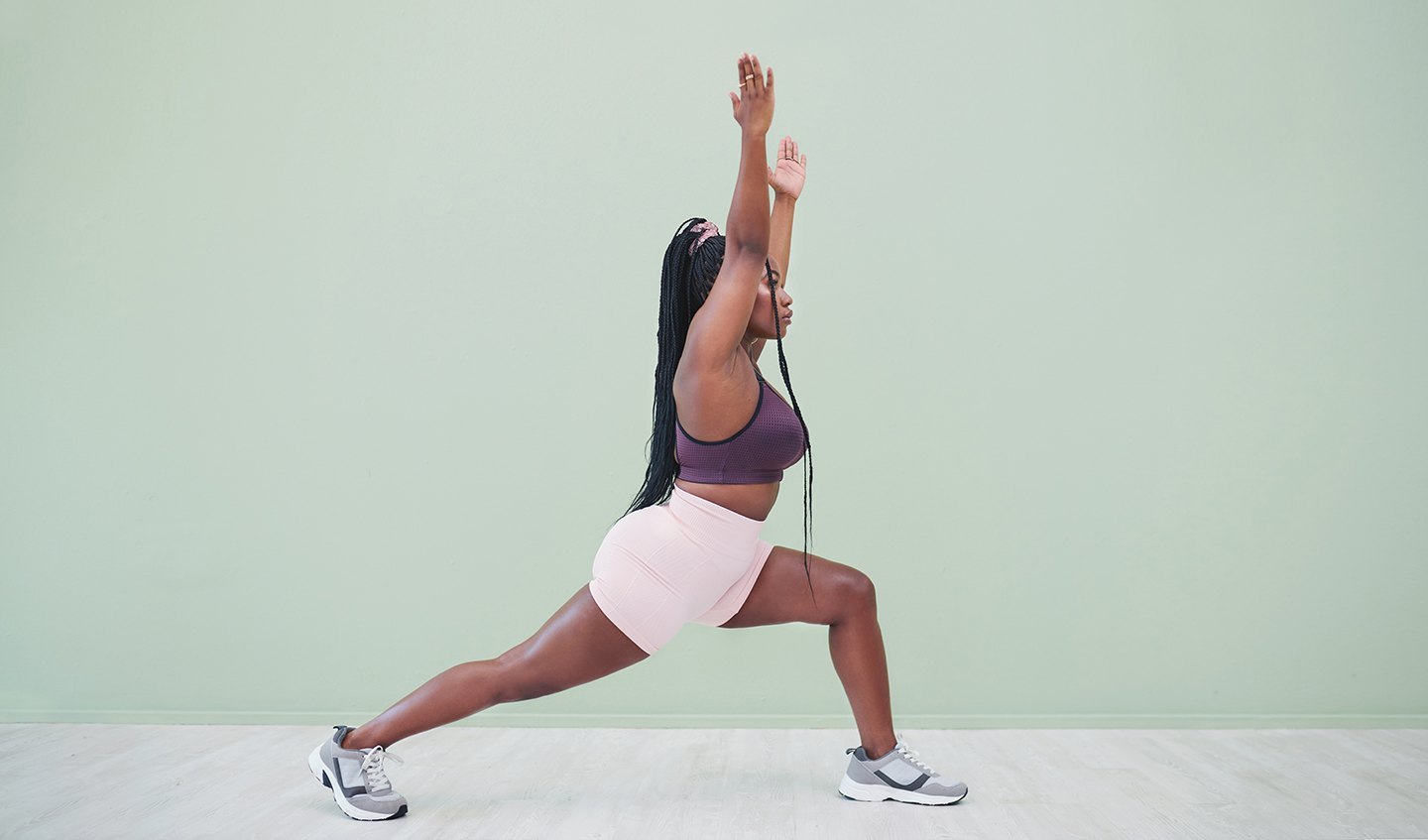

Our team of fitness experts is dedicated to helping you achieve your fitness goals. We understand that everyone has unique needs and preferences when it comes to fitness, which is why we offer a variety of workouts and exercises to choose from. Whether you prefer cardio, strength training, yoga or something else entirely, we have a plan that's right for you.

In addition to workout plans and exercise videos, we also provide nutrition advice and healthy eating tips to help you fuel your body for optimal performance. We believe that a well-rounded fitness routine includes both exercise and healthy eating habits, which is why we prioritize both on our fitness page."