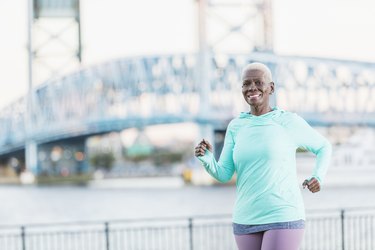

At our weight loss page, we understand that losing weight can be a challenging and sometimes overwhelming process. We offer a variety of resources to help you achieve your weight loss goals, including information on different weight loss methods and strategies.

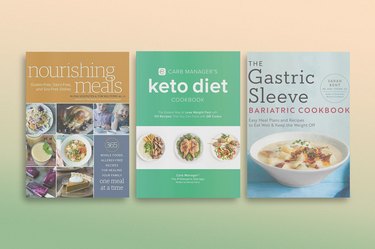

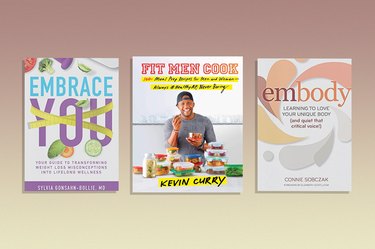

Our team of nutrition and fitness experts provides in-depth articles on specific weight loss diets and exercise plans, as well as general information on maintaining a healthy weight through lifestyle changes. We also offer advice on setting realistic weight loss goals, overcoming common obstacles to weight loss and staying motivated throughout your weight loss journey.

Whether you are looking to lose a few pounds or are seeking long-term weight management solutions, our weight loss page has something for you. We offer practical tips for incorporating healthy habits into your daily routine, as well as advice on how to address emotional and psychological barriers to weight loss."